Worthwhile

Simple solutions quickly available at your fingertips. Apply with just one document

Simple solutions quickly available at your fingertips. Apply with just one document

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

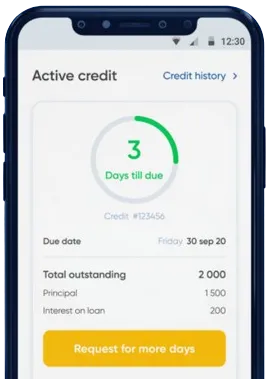

Seamless solutions in just 10 minutes from home. Instant money transfer and options to extend your loan

Apply conveniently via our app with a straightforward form.

Allow 15 minutes for our decision-making process.

Receive the transfer, usually completed within one minute.

Apply conveniently via our app with a straightforward form.

Download loan app

Quick payday loans are short-term loans that provide individuals with fast access to cash when they are facing unexpected expenses or financial emergencies. These loans are typically small in amount and are designed to be repaid within a short period of time, usually on the borrower's next payday.

One of the key benefits of quick payday loans is their speed and convenience. In South Africa, individuals can apply for these loans online or in person at various lenders, and the approval process is often quick, with funds typically being disbursed within a few hours.

1. Fast Approval: Quick payday loans are known for their speedy approval process, making them a convenient option for individuals in urgent need of cash.

2. Easy Application: Applying for a quick payday loan is simple and straightforward, with minimal documentation required.

3. Flexible Repayment: Borrowers can choose the repayment schedule that works best for them, making it easier to manage their finances.

4. No Credit Check: Unlike traditional loans, quick payday loans in South Africa typically do not require a credit check, making them accessible to individuals with poor credit history.

5. Emergency Financial Assistance: Quick payday loans can provide much-needed financial assistance to individuals facing unexpected expenses, such as medical bills or car repairs.

To apply for a quick payday loan in South Africa, individuals can visit the website of a reputable lender or visit a physical branch. The application process usually involves providing personal and financial information, as well as proof of income.

Once the application is submitted, lenders will review the information and make a decision on approval. If approved, the funds will typically be transferred to the borrower's bank account within a few hours.

It is important to carefully review the terms and conditions of the loan, including the interest rate and repayment schedule, before agreeing to the loan.

When considering a quick payday loan in South Africa, it is important to choose a reputable lender with transparent terms and competitive rates. It is also important to consider the lender's customer service and reviews from past borrowers.

1. Reputation: Look for lenders with a positive reputation in the industry and good feedback from customers.

2. Interest Rates: Compare interest rates from different lenders to ensure you are getting a competitive rate.

3. Fees and Charges: Be aware of any additional fees or charges associated with the loan, such as late payment fees.

Quick payday loans can be a helpful financial solution for individuals in South Africa who are in need of fast cash. With their speed, convenience, and flexibility, these loans offer a viable option for those facing unexpected expenses or financial emergencies. By choosing a reputable lender and carefully reviewing the terms of the loan, borrowers can benefit from the advantages of quick payday loans while managing their finances responsibly.

Quick payday loans are short-term loans that are typically repaid on the borrower's next payday. They are quick and easy to obtain, making them a popular option for individuals in need of immediate cash.

In South Africa, individuals can apply for a quick payday loan online or in person at a lender's office. The borrower typically provides proof of income and identification, and if approved, receives the loan amount in their bank account within a short period of time.

Requirements for quick payday loans in South Africa may vary by lender, but common qualifications include being a South African citizen or resident, having a steady income, and being over 18 years old. Some lenders may also require a good credit history.

Quick payday loans in South Africa can be safe if obtained from reputable lenders that are registered with the National Credit Regulator. It is important for borrowers to read and understand the terms and conditions of the loan before agreeing to it.

Quick payday loans in South Africa provide individuals with immediate access to cash when they need it the most. They are convenient and easy to obtain, making them a viable option for emergencies or unexpected expenses.

One of the main risks of quick payday loans in South Africa is the high interest rates and fees associated with them. Borrowers should be cautious of falling into a cycle of debt if they are unable to repay the loan on time.